A successful transition to a 21st Century Electricity System requires careful consideration of a range of issues that will ultimately redefine the regulatory framework and utility business model while creating new opportunities for third-party providers and customers to contribute to the operation of the electricity system. In this second of a 7-part series published by Utility Dive, AEE lays out strategies for achieving performance-based regulation. Previously, we covered Advanced Meters: Connectivity for the Modern Grid.

AEE believes that PBR, in its various forms, can serve as a foundational regulatory framework of the electric grid of the future. Future infrastructure investments must be evaluated in light of technological innovations, and judged on the basis of the value delivered by and through those investments.

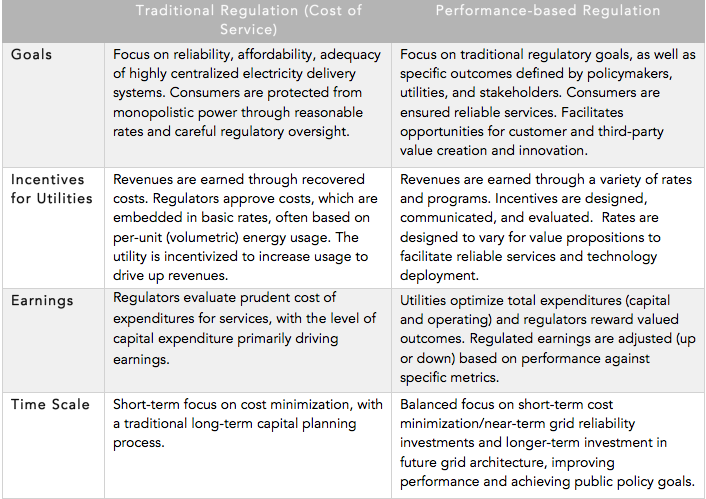

The idea of PBR represents an evolution from traditional utility regulation. Regulatory goals, utility earnings opportunities, capital investment incentives, and regulatory processes change to focus on performance.

Regulatory agencies establish PBR by creating links between regulated utility financial rewards (or penalties) and desired outcomes. These outcomes are tied to an index of performance in addition to, or in place of, the cost of providing services. PBR also can include other elements of regulatory reform, such as revenue decoupling and multi-year forward-looking rate plans. Used together, these changes to cost-of-service regulation can better align regulated earnings with desired outcomes.

PBR frameworks can also accelerate the way regulation reacts to market dynamics. Traditional regulatory processes can lag industry developments. This regulatory lag may unintentionally limit economic growth potential, slow technological advances and deployment, and negatively impact utility financial performance.

There is no one-size-fits-all solution for successful PBR deployment. Nevertheless, experience suggests that the following basic framework can be used to help policymakers and utilities design and implement changes that best fit their specific needs and circumstances:

- Establishing authority to implement PBR. Jurisdictions may have unique circumstances, including legal, institutional, utility, and financial market considerations.

- Stakeholder engagement. Stakeholder input in defining outcomes is crucial to PBR success. To increase transparency and stakeholder involvement, regulatory processes should ensure stakeholders are part of establishing the critical aspects of PBR plans – such as setting performance targets and incentives.

- Defining Performance. To implement PBR, legislators, regulators, and stakeholders should work together to define, prioritize, and incentivize desired performance.

- Establishing Metrics and Incentives. Generally, performance targets and metrics should be designed around the most important, forward-looking assumptions that impact the business case of a proposed utility investment. Although metric categories should be similar for all utilities in a jurisdiction, actual targets can vary from utility to utility to reflect differences in the customer base, system condition, or other factors.

- Planning in the PBR Context. Incentives are provided when a utility achieves certain goals (outputs); however, these new output incentives need to be considered in the context of the input incentives under which utilities currently operate.

- Optimizing Between Capital and Operating Expenses. One goal of a PBR framework is to put operating expenses on a more equal footing with capital investments, particularly when non-capital spending can provide a superior solution.

- Prioritizing Metrics and Learning. Prioritization is necessary to make the implementation of PBR manageable. Regulators and other stakeholders should focus performance objectives where there is most need for improvement, where there are opportunities to pursue regulatory priorities, and where there is opportunity for change.

PBR offers the potential to achieve policy objectives and improve public welfare while also retooling the utility business model for success in meeting those objectives. Experience shows that, with thoughtful design processes, rewarding performance can work well. Implementing PBR in each jurisdiction needs to be considered in the context of a utility system that is becoming increasingly complex. This suggests that a move toward PBR should also involve considerations of adjustment to the regulatory process as a whole. This should include greater involvement early on by various stakeholders that will ultimately play an integral role in the utility being able to meet its performance targets.

AEE’s issue brief, Performance-Based Regulation: Aligning utility incentives with policy objectives and customer benefits, as well as six other related issue briefs, are available for download.