This post is one in a series of feature stories on trends shaping advanced energy markets in the U.S. and around the world, drawn from Advanced Energy Now 2016 Market Report, which was prepared for AEE by Navigant Research.

The industrial sector accounts for roughly 50% of U.S. electricity consumption, and more than 30% in Europe. This presents a major opportunity for energy and nancial savings are a major opportunity for the companies operating in this sector. Industrial Energy Management Systems (IEMS) analyze and manage energy consumption and operations data within an industrial facility, delivering actionable information to managers of industrial facilities.

These analytics-based tools help industrial customers make strategic investments and equipment improvements as well as monitor the impacts of energy ef ciency measures, from capital-intensive system replacement to

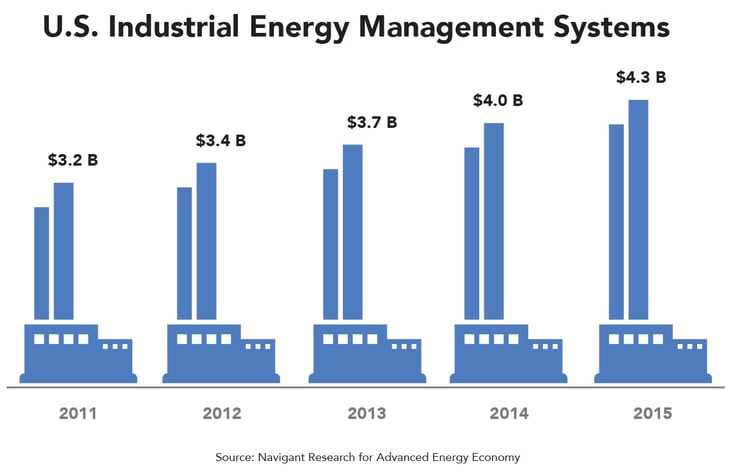

no-cost operational changes. IEMS revenue reached $13.5 billion worldwide in 2015, up 9% from 2014 – a 38% increase over 2011, as a result of steady annual growth. The United States market reached $4.3 billion in 2015, up 9% over 2014, and 36% over 2011.

Major IEMS customers include manufacturers, food, textiles, transportation equipment, and many other sectors. IEMS are deployed on industrial processes including pumps, air compressors, fans, materials handling and processing, and refrigeration making up the majority of an industrial facility’s load profile.

Companies are increasingly realizing the nancial business case for IEMS investment, as these systems increase budget certainty by providing tools for predicting potential maintenance, energy, and capital costs. The software and services provide insight into energy-related financial underperformance by analyzing operations against energy costs, including utility rates, demand charges, and wholesale prices.

Leading companies providing IEMS include Emerson Process Management, AECOM, and Schneider Electric. These solution providers serve a variety of industrial sectors, including chemical, oil and gas, re ning, pulp and paper, power, water, mining and metals, food and beverage, and life sciences. As an example, Emerson Process Management offers Energy Advisor, a real-time energy management information system that automatically monitors and manages energy consumption across plants, mills, and re neries. Schneider’s StruxureWare is a platform of applications that gives clients visibility into energy consumption and other resource utilization across the organization, including electrical management, automation, building management, critical power and cooling, and electrical distribution services.

IEMS is also a viable solution to help energy service companies better manage and monitor industrial projects. Companies like Ecova, CLEAResult, and others partner with a utility to enact energy savings across the utility’s industrial client base. IEMS can support these partnerships with the tools for measuring and monitoring the impact of ef cient measures and ensuring persistent savings. Because the industrial sector is such a large consumer of electricity, even minor improvements, enabled by real-time data and process improvements, can result in signi cant nancial savings.

Navigant Research forecasts the global IEMS market will grow from $13.5 billion in 2015 to $35.6 billion in 2024, increasing at an 11.4% CAGR.

In North America, regulatory drivers are expected to have a less direct impact on the market. That said, the mid- and long-term impacts of EPA’s Clean Power Plan could accelerate interest and nancial support of energy ef ciency investment in the U.S. industrial segment. IEMS vendors can take advantage of this growing opportunity to engage customers with software and services to meet their energy management objectives. The North American market is expected to grow at a 10.9% CAGR through 2024.

Meanwhile, the European Union (EU) will continue to pressure industrial customers to improve energy ef ciency and reduce greenhouse gas emissions under the regulatory framework of the EU Emissions Trading Scheme (ETS) and Energy Ef ciency Directive (EED). Corporate commitments to sustainability and climate change mitigation are also expected to bolster opportunities for IEMS vendors in the region. Navigant Research forecasts an 11.5% CAGR for the region through 2024. But the fastest growing market will be Asia-Pacific, projected to grow at a 13.4% CAGR during this time.

Download Advanced Energy Now: 2016 Market Report from the link below: