This is a guest post from AEE affiliate member Navigant. To learn more about Navigant, click here. To learn more about membership in AEE, click here.

Storage has long been relegated a trend to watch in the next 10 years – but not a trend of today. Until recently, it was considered too immature (in terms of technology) and too expensive (in terms of capital investment) to be a serious contender in the utility space. Over the past two years, however, a slew of megawatt-scale storage plants started coming online to compete in PJM’s fast-response frequency regulation market. This market development has had two positive consequences for storage: It has helped lower lithium-ion battery pricing, and it has piqued the interest of developers. As a result, storage is now.

The combination of energy storage and demand response (DR) was named one of the most useful tools available today for utility operations in the next 10 years in a survey of utility leaders published in a recent edition of Public Utilities Fortnightly. It was also named one of the most disruptive trends. Although disruption for disruption’s sake is not the goal, it can prod stakeholders into action, encourage creative business models, and inspire reform. Market disruption means winners and losers – and in this case, utilities are positioned to be winners, along with storage suppliers and their large behind-the-meter customers. Losers could be peaking power plants and their developers.

The electric utility industry has several tipping points on the horizon, and storage has a few tipping points of its own, including reaching parity with natural gas peakers and thermal assets, as well as storage-enabled virtual power plants (VPPs). Natural gas peakers have their costs: They require fuel, take longer to build than similar sized storage plants, require water for cooling, and are used only during demand peaks—a fraction of the time. When storage reaches parity with natural gas peakers, true competition will ensue.

Parity is closer now than ever before, as storage prices continue to decrease, particularly for advanced batteries. And the benefits of storage for utilities and grid operators are coming into focus: Storage can help make the most of solar and also help utilities avoid costly upgrades to transmission and distribution lines. Storage can also shift wind energy, which often peaks at night, to the times of day when it is needed most.

The final tipping point is the energy-storage enabled VPP. Thanks to recent cost declines, robust business cases for commercial and industrial (C&I) storage, and incentives such as the Self-Generation Incentive Program in California, distributed storage is gaining a foothold in the U.S. market. Energy storage serves as a foundation for VPPs, making it possible to add more and more variable assets including wind and solar PV, electric vehicle charging, and DR. Third-party vendors are developing these VPPs – in some cases, on behalf of utilities.

Tipping points represent opportunities, but they also represent challenges. The first critical challenge for storage is regulator buy-in. Some markets already have a framework in place to encourage storage; New York and California are two examples. Absent strong leadership from regulators, utilities need to educate regulators and their own organizations on the technologies, benefits, and business models for energy storage.

The second key challenge boils down to accurately modeling storage for planning purposes. This includes using the correct data points for storage and the right modeling tools to accurately display the costs, benefits, as well as an appropriate plan for storage in a service territory.

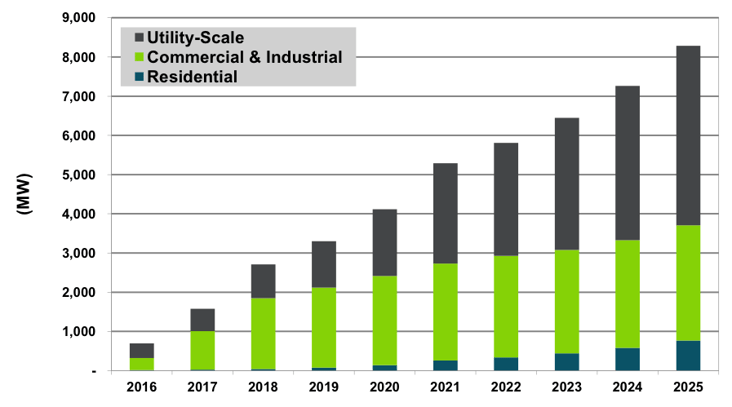

These challenges notwithstanding, North America is a leading market for energy storage, especially in the utility-scale and C&I markets. Absent utility interventions such as utility-led residential VPPs, residential storage is expected to account for only 2.6 GW or 6% of the market over the next 10 years. The market for both utility-scale and C&I storage, however, is large and growing, with 22 GW of storage forecast to come online in utility-scale applications and another 20.7 GW of C&I storage.

These forecasts include advanced batteries; in the case of utility-scale storage, they also include technologies like ultracapacitors, flywheels, and compressed air and pumped storage. Thermal storage is not included in these numbers, and any thermal storage would be in addition to the figures quoted here. In the next 10 years, 45.4 GW of storage is anticipated to come online in North America, accelerating from 696 MW in 2016 to 8,285.2 MW in 2025.

Annual Energy Storage Power Capacity Additions by Segment, All Technologies, North America: 2016-2025

Source: Navigant Research

Over the next 10 years, Navigant Research expects 155 GW of storage to come online globally. Most of this capacity will be utility-scale storage—60%, or 93.8 GW of large-scale storage. In contrast, 48% of the total storage capacity in North America will be utility-scale storage, mainly because many of the best sites for pumped storage are already developed. The remainder of the global storage market will be split between the two distributed markets—C&I and residential. The global C&I market is expected to account for 32% of the total market, and residential will pick up the remaining 7.6% of capacity, or 11.8 GW. The North American market for C&I storage is projected to grow faster than the global market—largely thanks to demand charges (which onsite storage can help reduce), a healthy number of developers, and a strong business case. In fact, C&I storage is forecast to be 46% of the North American market and 42% of the global market for C&I storage overall.

Both distributed markets could grow even faster as VPPs develop to monetize the value of energy storage. Some utilities are already doing this—HECO, SCE, Green Mountain Power, and Con Edison all offer a version of a storage-enabled VPP to customers as a pilot or commercial project. These utilities are on the leading edge of this storage tipping point.