This summer, the House Energy & Commerce Committee wrote a letter to the Federal Energy Regulatory Commission (FERC) seeking the agency’s input on the challenges facing our electric grid and the organized wholesale electricity markets which FERC regulates. Driven by a number of factors, including environmental regulations, changing consumer expectations, and booming growth in advanced energy technologies, the grid is undergoing rapid changes, the letter notes. In light of these changes, the Committee wants to explore questions about whether the organized competitive electricity markets established in the 1990s have delivered on promises to lower costs, maintain reliability, and spur innovation and whether Congress should amend the underlying law, the Federal Power Act. A formal hearing will take place tomorrow.

Organized markets are the best way to facilitate competition and drive down electricity prices, but, as they exist now, the markets overseen by FERC are far from perfect. AEE hopes members of Congress will use the hearing as an opportunity to highlight ways these markets can be improved. AEE is working with the R Street Institute - a think tank whose motto is “free markets, real solutions” - to help Congress see how these markets work and how they can be improved to take advantage of the benefits advanced energy provides.

In anticipation of the hearing, AEE and R Street Institute held a briefing for congressional staff on the issues outlined in the Committee’s letter to FERC. At the briefing, AEE outlined how ongoing technological innovation is changing the way we produce, manage, and use energy. Organized competitive markets are well-suited to integrate new technologies. But the rules that govern how these markets operate need to be adapted to allow new market participants, like advanced energy companies, to compete.

The briefing followed the release of a new paper, Wholesale Electricity Markets in the Technological Age, published by the R Street Institute. The paper describes how organized markets have brought down consumer costs and successfully maintained grid reliability, and notes ways these markets can be improved. An improved organized market would “reduce barriers to entry, lower transaction costs, provide clear investment signals that spur innovation and compensate resources fairly and efficiently.”

Organized markets have proven they can adapt to and facilitate the deployment of new forms of energy and innovative solutions to energy challenges. In what the paper calls the “virtuous circle between competition and technological advance,” R Street writes that, “as these markets developed, they in turn accelerated innovation and the deployment of advanced energy technologies.” Further improvement on the design of the market would provide additional benefits, many of which come from “taking better advantage of the value provided by advanced energy technologies.” According to R Street, one of the biggest areas for improvement is “remedying incomplete market design and enabling fair market access for advanced energy technologies.”

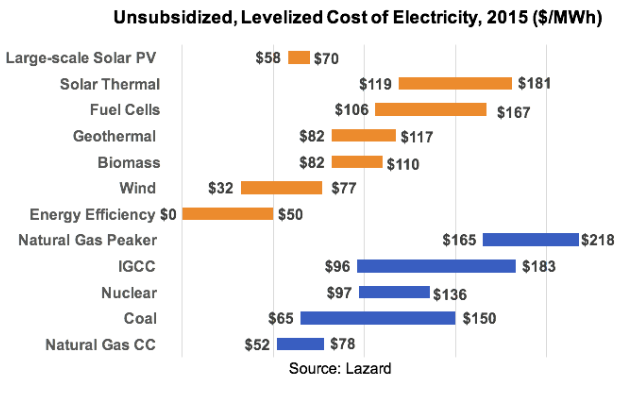

Advanced energy would thrive in the type of well-designed market described by R Street. Many of these technologies can already compete with traditional energy resources on the basis of unsubsidized cost. This graph shows the levelized unsubsidized cost of electricity from select technologies.

Moreover, many advanced energy technologies have unique characteristics that allow them to provide valuable services that improve grid performance and reliability. Demand response, for example, can help maintain grid reliability without the need to dispatch more expensive generation at times when demand is high. Energy storage can provide frequency regulation and instant-on power where it is needed. Current market rules do not adequately compensate these advanced energy technologies for ancillary services, leaving the full benefits they provide unrealized. In other words, as R Street Institute writes, the markets for some ancillary services are “incomplete.” That means they are failing to allocate resources efficiently and not sending the complete market signals that spur innovation and investment.

R Street describes in detail the shortcomings of transmission planning in organized markets and shows how it precludes competition from new market entrants like advanced energy technologies. As AEE noted in a recent blog post, spending on transmission and distribution infrastructure has been rising steadily without a corresponding improvement in reliability. More competition from advanced energy could help drive down transmission costs and do more to improve reliability. The transmission issue highlights a key theme in the way organized markets are designed. Many of the current market rules are designed with older generation technologies in mind and tend to favor incumbent technologies. Transmission is not the only example.

In order to participate in this year’s capacity auction in PJM Interconnection - the grid operator that manages the organized market for most of the mid-Atlantic region - participants had to meet new requirements to be available 24/7, 365 days per year. The new requirements were adopted by PJM in response to the 2014 Polar Vortex, during which unusually cold weather shut down several conventional power plants, threatening reliability. Wind generation (which functions just fine in cold temperatures) and demand response helped keep the lights on. PJM’s all-the-time, anytime requirement is designed to ensure resources can operate when they say they can and penalize them when they can’t. Ironically, the requirement precludes some of the very resources which helped maintain reliability during the Polar Vortex (wind and demand response) from participating. These resources can contribute reliable power during emergencies. But, because they don’t share the operating characteristics of a traditional power plant, they’re excluded from participating.

A better market design would enhance performance “while simultaneously expanding market access for advanced technologies and ensuring market participants have appropriate incentives to use advanced technology…[and] facilitate innovation in advanced technologies.”

Using markets to solve problems by letting advanced energy compete can be a bipartisan solution to the challenges facing our 21st century electric grid. As Congress explores this issue in more detail, AEE hopes that members will focus on how organized competitive markets can be improved to capture the benefits advanced energy can provide.

Keep up-to-date with all advanced energy policy news by subscribing to AEE Weekly: